As I continue this series on the housing crisis, I want to turn my attention to an especially essential element in the property development funding process – valuation. The valuation professional is critical to the current system of development funding and though the cost of the service is quite minimal in the overall development, the final valuation has profound effects on both the course of the development and the final cost.

Earlier this week, this news article came across my feed.

ASIC shone a light on private lending and did not like what it saw

What attracted my attention, and convinced me to go ahead and author this article was this sentence from the news item;

“What it uncovered was inconsistent and unclear reporting, risks that had been downplayed, opaque fee structures, conflicts of interest and poor valuation practices.”

This raises some particularly important questions.

The first question is, who do valuers work for and to whom do they owe a “duty of care”? Those of us who have practiced as professionals in one field or another, know that our duty of care is owed to a very wide range of people, not least, the one who pays the bills. The one who pays the bills may be the starting point, but that duty expands to include, people we do not even know, to the community as a whole. I say this, because a professional is, finally concerned with the common good.

In the development industry, it is the case that even though the developer pays for a valuation and thus entitled to the benefit of the service, the valuer often minimises the needs of the developer, often ignoring them altogether. In almost every case, the valuer is more concerned to protect (i) their own interests and (ii) the interests of the financier.

The conflict of interests uncovered by the regulator, is no more evident than at this point. The reason why the valuer puts the needs of the financier above those of the developer who pays its bill, is because the valuer is very highly likely (indeed, I would say, 99.99% likely) to be a member of a panel of valuers who serve the interests of the financier. Given the bargaining strength of the financier in the transaction, the developer has extraordinarily little power to ask for a completely “free and independent” valuation.

In order for the transaction to proceed, the developer MUST use one of the preferred, panel valuers. This is an instance of “third line forcing,” where the initial provision of services is made dependent on the exclusive use of certain nominated third party valuers. The legality of such practices is certainly questionable, but the professional morality is not. It is fundamentally unethical and unworthy of professional practice, leading to moral hazard, which has a contagious effect on the industry and by extension, the common good. I will endeavour to explain this below.

In short, in exchange for preferential treatment and ongoing commissions, all other professional considerations are ignored.

This leads to the second question; what are the poor valuation practices identified by the regulator?

They are more than obvious. The valuer is put in a position where “moral hazard” becomes a reality. They are arguably, dishonest, and highly likely, guilty of professional misconduct and malpractice. The data I have from our own experiences is quite damning and I find myself wondering at times, if I should take this further with ASIC or even to the press? In the analysis below is just one real life example.

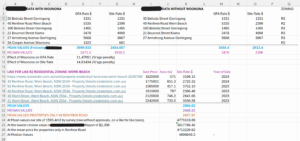

The table below is an analysis and cross-check of the valuer’s report prepared in 2024 for the refinance of a project of ours on the South Coast. The valuer (who I will not name here) did something, which I will not hesitate to say, I found dishonest and unconscionable. I can say this with impunity because it is a fact. The issues were as follows:

- It included in its valuation analysis, a site at least 100 km away from the subject site, in a different type of market and at a different price point. This stands out like a throbbing thumb, let alone a sore one and its inclusion in the valuation had demonstrable, severe detrimental effects.

- It totally ignored all relevant “like for like” sales, all within the subject suburb itself and at maximum of a couple of hundred metres of the subject site, half in exactly the same street and with every one of those “like for like” sales, within the same time period of the valuation.

- Almost all the other sites were in much lower median value suburbs, which though very close in proximity to subject suburb, were not “like for like” markets then or even today.

Here is the analysis.

The detrimental effect to the end valuation of the inclusion of the site more than 100km away is more than obvious. By including the outlier figure, the penalty to the valuation was 14.6%! That may not seem much but when the effect is telescoped throughout the project, 14.6% of a roughly $4M valuation is = $584,000, and 65% (LVR) of that is $379,000! That was more than enough to expedite the CC and the project ready for construction, many months earlier, thereby saving large amounts of interest and additional holding costs.

The analysis above was an unbelievably valuable exercise for us, as it enabled us to actually quantify the genuine cost of this failure to exercise of professional integrity.

The cost was far greater than just the fee paid to the valuer. It included the lost financing due to the valuations discount (see above) and the follow on costs of a longer holding period. In the end, an additional $550,000 – $600,000 in superfluous and unnecessary costs were added to the project, all of which flowed to the financier (less the minor fee paid to the valuer).

This cost, when added to the entire cost of the project (net of financing costs), added another 5.7% cost to the project as a benefit to the financier, in addition to the interest costs overall. The cost of delivery inflationary effect over a three year project lifecycle is 1.9% pa, which when added to the inflationary effect of the private credit financing (see my article in our HORIZONS page or my post on LinkedIn) has an inflationary effect on the cost of project delivery of 9.51% pa + 1.9% pa = 11.41% pa.

And there you can see, with quantifiable data available over a number of projects over a number of years, the devastating effects of the filling of the financing vacuum created by regulators and retail banks, by “private credit.” As always, the most vulnerable suffer because the most devastating effect is felt at the bottom half of the housing market where the NEED is by far the greatest!

This is the new normal https://www.youtube.com/shorts/D8qqTiIRpjg

The valuation profession joined at the hip of the private credit financial service industry is actually quite deadly. Like the flapping of butterfly wings in the Amazon, what seem innocuous, eventually creates great storms, which cause profound diminishment of the common good. This is an issue of national importance and high public interest given the compounding effect it has on the current housing crisis.

One solution would be to prohibit panels of valuers as anti-competitive behaviour and as a practice not in the public interest. Valuers could then be engaged freely and independently by developers and financiers alike and valuers would have to stand “on their own feet”. As professionals, they would rely on their professional indemnity insurance, but of course, if they were honest, diligent, and transparent, they would have very little to worry about.

The other solution is to regulate the industry. From what I am seeing, there is a ground swell of opposition to the current system both in industry and in government.

As the article above says, ASIC launched a “surveillance program” over a year ago. They did not like what they saw. Well, I cannot help but wonder, how long will it take to act to curb the worst effects of this new usury?

We have an alternative solution. Seek out investors and partners who are happy to make a return slowly, brick by brick. As we model the effect of almost complete equity funding over longer periods as an alternative to debt funding with its demand for rapid return and total unconcern for social effects, the results are striking! The ancient wisdom proves true even today;

“Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.”

Reach out and join us if you want to make a difference.