In this article, I describe a type of investor who invests for reasons other than just making money. This type of investor desires to contribute to the common good, while satisfying their own needs. They see themselves as accountable members of the family of humanity, not as unrooted, nihilistic individuals trying to fill their lives with as much pleasure as possible before the inevitable end. They stand ready to try and change the current system.

This is the type of investor Pleroma Property Investments is looking for!

The main characteristic of the current system and why we are opposed to it.

This current system is best described in these words of Thomas Hobbes; “And because the condition of Man . . . is a condition of War of every one against every one; in which case every one is governed by his own Reason; and there is nothing he can make use of, that may not be a help unto him, in preserving his life against his enemies; It follows, that in such a condition, every man has a Right to every thing; even to one another’s body.”1

Ironically, Hobbes was trying to describe the human condition before the advent of government. The irony is, that it actually describes the society that we live in; a society that worships money and with government complicit in that idolatry!

Really? A right to everything and everyone, if it is in our own interest?

Yet, many believe it! And so, slavery in the supply chains of consumer goods is justified; exploitative child labour is justified; preying on the weak and vulnerable by big business is justified. It also corrupts to varying degrees, every government on the face of the earth; the environment is raped and pillaged and finely tuned eco-systems either damaged beyond repair or destroyed altogether.

Tragically, we have come to view ourselves and our home as no more than a means to an end, to be used and abused in the pursuit of our own self-interest; an insatiable appetite for “things”. A few do undoubtedly benefit in a material sense, but it has come at great cost to the vast majority of humanity and to the health of the planet, the home which we all share.

Look at the image below. Does this not disturb people of good will? The headline to this photo was “Fears Perth becoming ‘tent city’ due to rising rents”. This, in one of the world’s wealthiest countries – just imagine what is happening in poorer countries.

© 7news.com.au (in the public domain – accessed 20th October, 2025)

How do we break this model?

It’s not easy! The love of self and money is so ingrained, it will take a radical change in world view to make any real headway or to avert major catastrophes. Nevertheless, we can take some positive, smaller steps to make changes for the better. A good place to start is to revisit what we mean by two very important terms; “invest” and “value”.

What does it mean to Invest?

We all know the common meaning of the word. It is doing without the immediate enjoyment of the benefits of assets (like cash) in the hope that by “investing” (putting it to “work”) we can gain more in time. We do it in hope of having more to spend to satiate our appetites.

Now, it may surprise you to learn that this particular understanding of the word has only evolved in the English language very recently.2 It came into English in the late 14th century and originally meant “to clothe in the official robes of an office,”3. We still use it in this sense but only very rarely, and mainly when we speak of something like the “investiture” of a prince or princess. Nevertheless, I really like this older use of the word. It indicates that investing is about much, much more than just making a profit. It is about turning something less noble in use, into something more noble in use. It is about creating something of real value.

Money, in and of itself is quite ignoble. It doesn’t “create’” anything of lasting value4 – only people do.

What Does it Mean to Create Something of Value

The Concise Oxford Dictionary defines “value” in a number of senses. The one in which the word is most commonly used is; “the regard that something is held to deserve; importance or worth…”5 It came into English from Latin, where it meant, according to the Oxford Latin Dictionary6, mainly, to “be strong” or “physically powerful”.

It was also used in the following sense: “To be in sound health, be well. (In greetings, perh. w. implication of general well-being.) (b) (w. advs.) to be in (good, bad, etc.) health. (c) (as a formula at the beginning of letters). (d) (in asseverations)”7. Travelling from Rome, the word made its way to Paris during the Middle Ages, where it ended up meaning “worth, price, moral worth; standing, reputation”8 .

I won’t labour the point, but surely a peaceful, just and contented society, good health, and mutual respect are things of real value and worth having. Possessing these makes everyone rich, irrespective of the size of their bank accounts. Surely, a model to create these things is far better than the current model which pits human against human in a mad, senseless, often violent and zero sum game. Asserting one’s “rights” against another’s has never ended well. There is no reason to expect that it ever will.

An Alternative

It is possible to change the current status quo. I am going to put an unqualified assertion out there: change will come from the bottom up, driven by people of faith and good will!

My justification for the assertion is a perceptible pendulum swing back to faith and the quest for things of greatest value. This is particularly evident in younger generations. As they question and indeed, reject the current intellectual fads and orthodoxies, they rediscover older intellectual and spiritual treasures. This has begun to impact their economic decision making.

They recognise that ownership of things is transient and uncertain. Things can only be owned while we live and even then, the length of time we own them, is even more uncertain for, “moth and rust consume and thieves break in to steal”.

They see investing as an opportunity to do good for others while simultaneously meeting their own needs. Indeed, I think this attitude is going to continue to grow as we see these green shoots of faith maturing. This is understandable. They will be the ones who will have to live with and clean up (if they can) the messes older generations are leaving behind.

Does Faith Based Investing Work?

The short answer is yes; it does. It may be an investment strategy driven by certain personal ethics, but it is still an investment activity and therefore, it needs to be said, attracts risks. However, data is emerging, that faith based investments, equal and often outperform traditional investments.

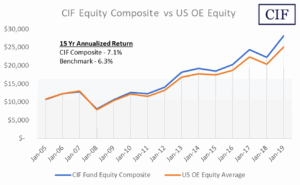

For example, a 15 year study of faith based, index funds compared to benchmark industry funds in the US found that the faith based funds matched returns from industry benchmark funds in early years and began to diverge positively as time went on9.

The CIF Composite tracked 44 Christian funds in both equities and bonds for a period of 15 years, capturing performance in various market periods (bull and bear) and including the US “Great Recession” of 2007-2009. The results show that the CIF composite outperformed the US equities benchmarks.

This phenomenon is not limited to the United States. Here in Australia, Australian Ethical, for example, a values based investment and superannuation fund has ranked in the top 10, out of literally hundreds (if not thousands) of investment and superannuation funds with returns consistently outperforming benchmark rates10.

Doing good brings many kinds of rewards; financial rewards included.

One interesting trend emerging in both the United States and here in Australia is growth amongst younger cohorts; “Speaking to Money Management, Mark Simons, the firm’s chief financial officer, said the fund manager stands out against peers for its active ethical approach which is particularly attractive for younger investors.”11

This attractiveness to younger investors is made plain; “Every investment we make is made in line with our Ethical Charter which seeks to do good by people, animals, and planet. This appeals to our consistently growing customer base, and especially young Australians”12.

A profound change is taking place and I believe it is gathering steam. New generations are emerging which do not accept the status quo and who can see very clearly how destructive the current system, founded on concentrated capital and the practice of usury, really is.

A real life example

I will illustrate that the “cost” of capital under the current system, is inflationary and destructive. It is a non-productive cost that causes the final price of things to skyrocket upwards. Housing and shelter are severely impacted, as the whole world is now finding out!

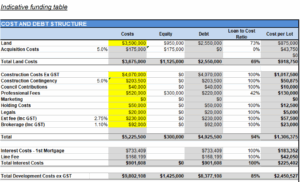

Here is a real life example of what we have to deal with. This is for a “high end” project of only 4 housing units. The numbers are very telling and repeat themselves over every price segment of housing. This is an offer for finance summary by one particular funder (the best offer made to us).

The arithmetic is very simple. When “financing” costs (interest and fees) are added over the 18 months required to build and sell, they add $1,223,608 in costs. Think about that! That is an additional $305,902 per living unit which has to be covered in the sales cost. And this does not even start to consider the costs of holding these properties while waiting for approvals.

The total cost of the project without the financing costs is $8,579,000. A first year high schooler can work out that the financing costs, inflate the “cost of delivery” by at least 14.26% or an average 9.51% pa over the 18 months to build and sell.

What is not readily seen in these figures is the fact that the lender, in determining their offer, dropped the sales price in the original feasibility study by $450,000 per housing unit so that their feasibility would reflect the sales price where the return to the developer was the minimum 17% required to approve the loan!

Here’s my point. Even with the final sales prices discounted by $450,000 per housing unit, there was still 17% to be made on the “cost of delivery + financing costs”. Think about that for a moment. Without the practice of usury, 17% + 14.26% = 31.2%. That is what would be available to the investors who put the whole cost in, while at the same time $450,000 could still be deducted from the final sales price! It leaves plenty of room for an even greater return. The lower return may not be good enough for the greedy, but our hope is for investors who can say, “It is good! I have enough – let’s leave some gleanings for those in real need”!

Only rare people look beyond short term gain and think like this. And sadly, it’s not all people of faith. Too many are actually part and parcel of the existing system and are so blinded by it, they seek clever ways to justify it. We experience this daily. Hope is in the younger cohort of faith investors, as others have also recognised.

Concluding remarks

Can you imagine the effects of usury at the cheaper end of the housing market, where the need is greatest and the social risks most heightened? Is it any wonder that the cheaper end of the housing market, is being abandoned by developers?13 Sadly, it is here where, not only is human need greatest, but human distress will also be greatest.

The current financing system concentrates wealth in too few hands. One of the most disheartening stories I have read recently concerns ultra wealthy families in North America shifting their lending priorities: “The richest families in North America are quietly reshaping how they invest their money — trading the high-risk thrill of startups for the steady pull of private credit and property.”14

By demanding more property assets, they cause inflation in the property sector. They also lend at rates way above the rates at which regulated banks lend, again causing inflation. Finally, the seek out and create a class of “wage slaves” to repay their “private credit”. Imagine having someone working for the next, 25, 30, 40 and even 50 years or more, paying off a mortgage? And what happens, if the wage slave becomes incapacitated and can’t pay the mortgage? One word – NEXT!

This is the Hobbesian world we live in.

Why we at Pleroma Property Investments are Different?

We understand how destructive this system is. We have experienced it first hand and have borne the brunt of its evils. That is exactly why we are fighting back, in faith. We believe that investing should be for the common good; our benefit and the benefit of others, investors and end users alike.

We are more than just property developers only wanting to make money. We see ourselves as co-citizens of a larger community. We are busy creating new ways of living while repairing the environment, one site at a time. Property development is a great way to do this. The results are tangible. Furthermore, we believe that every successful project advertises the possibility of something even better.

We want to start a movement, but we need help.

We need investors and partners who are visionary, compassionate, committed to the common good and happy to grow their own and many others wealth slowly. This is one of our driving principles – to share whatever wealth we create as widely as possible.

If you are interested in what we are trying to do and would like to be involved in some way, please reach out to us.

A few small sparks can start a fire going!

Dr Jim Kapetangiannis, 2025

- Hobbes, T., Leviathan, 1651 published by the Gutenburg Project https://www.gutenberg.org/files/3207/3207-h/3207-h.htm (accessed October, 2025

- Invest – Etymology, Origin & Meaning

- Ibid

- What Is Money? Definition, History, Types, and Creation

- Concise Oxford English Dictionary, 10th Pearsall, J. Ed, Oxford University Press, 1999

- Oxford Latin Dictionary Oxford Latin Dictionary | PDF accessed October, 2025

- Value – Etymology, Origin & Meaning

- Ibid

- CIF Highlights+-+CIF+Study+on+Faith+Based+Fund+Performance+(Spring+2020).pdf accessed October 2025

- See here Join Us | Australian Ethical Super and here Compare Super Funds Australia | Finder and here How Australian Ethical is beating active peers | Money Management

- How Australian Ethical is beating active peers | Money Management

- Ibid

- See here Australia housing crisis: New home builds fall 27% short of target amid calls for reform and here Developers abandon apartment market – MacroBusiness and here https://www.youtube.com/shorts/D8qqTiIRpjg

- Ultrawealthy families are pouring billions into private credit and real estate, but cutting back on early-stage startups